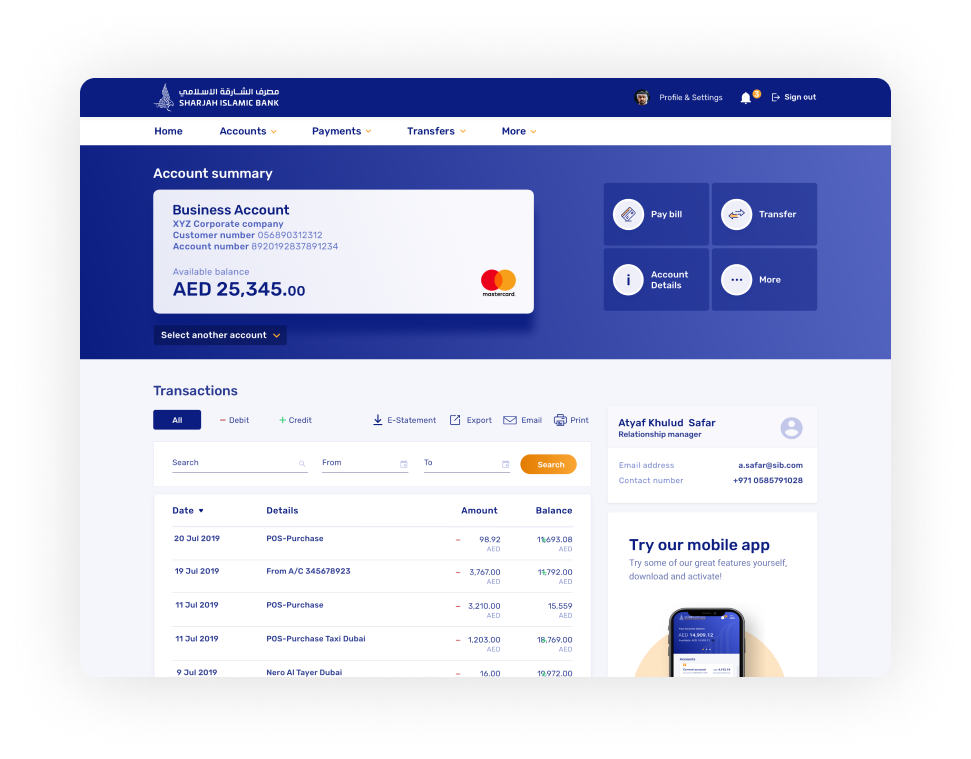

Digital and Mobile Banking Platform

Digital and mobile banking service for retail and corporate customers of Sharjah Islamic Bank.

Company

Shajah Islamic Bank

Role

Design Lead

Duration

1 year

Location

Dubai, UAE

Overview

Sharjah Islamic Bank (SIB), previously a state-owned National Bank, is a publicly listed retail and corporate financial institution in the UAE Emirate of Sharjah.

In 2018 the bank began a program of investment which aimed to deliver a wide-ranging modernisation of its core platform and associated customer-facing digital online and mobile banking services.

As the head of the design team at RBBi I was responsible for the end-to-end management and delivery of the service and experience design component of the digital online and mobile banking modernisation.

The Challenge

As with any broad scope banking project there were many competing challenges that had to be carefully balanced to ensure positive outcomes for the bank and their customers.

Customers in the region have high expectations regarding the availability, usability, and capability of online and mobile banking services. Additionally, a highly competitive market filled with innovative and well funded providers ensures that the baseline standards of functionality required for perception as an attractive option by customers is also high.

Given that programme budget and timescales are limited, it was necessary to thoughtfully and continually manage where time and resources should be allocated, competitive differentiators could be leveraged, and how senior stakeholder expectations could be controlled and met without the need to absorb runaway scope creep or disruptive rework.

Key Responsibilities and Achievements

- Primary point of contact between the client, 3rd party vendors, and the agency regarding the design workstream. Attending the weekly status meetings as the representative responsible for the design workstream.

- Worked with the bank to plan and execute customer understanding research.

- Managed competitive benchmarking research and worked with the bank stakeholders to align this with opportunities for competitive differentiation.

- Developed and owned the project plan for the design workstream, working closely with the client and vendors to ensure alignment of delivery with the programmes critical path.

- Managed the translation of business requirements into a format that could be briefed to the UX and Visual Designers working on the project.

- Reviewed and signed off on all design work internally ahead of presentation to the client, ensuring that high levels of consistency and fitness for purpose was being achieved.

- Responsible for presenting to client stakeholders and ensuring approval of design work produced by the agency team.

- Created key design concepts and flows that would be implemented by the design team.

- Mentored the design team, helping with comprehension of banking concepts and processes.

- Oversaw usability testing efforts. Presented findings and recommendations back to the client.

More Case Studies

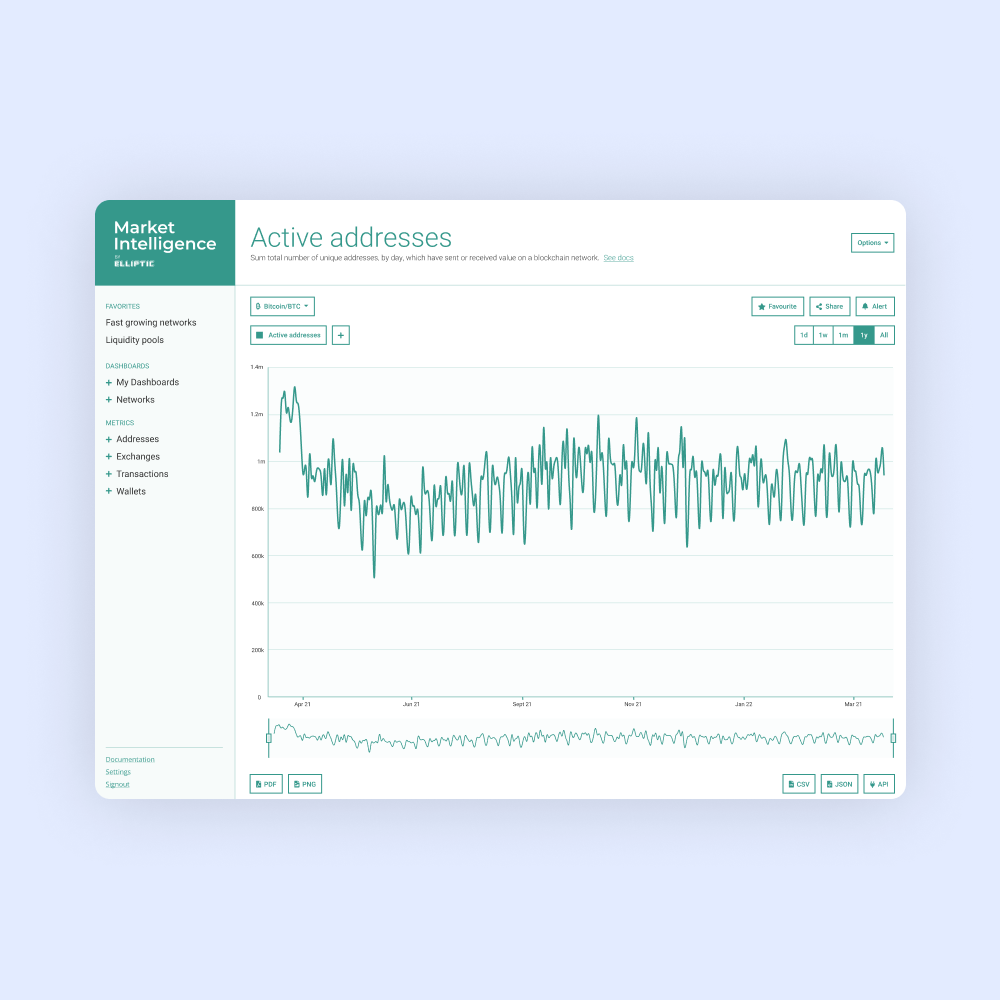

Market Intelligence Platform

Helping investors generate alpha from crypto asset markets.

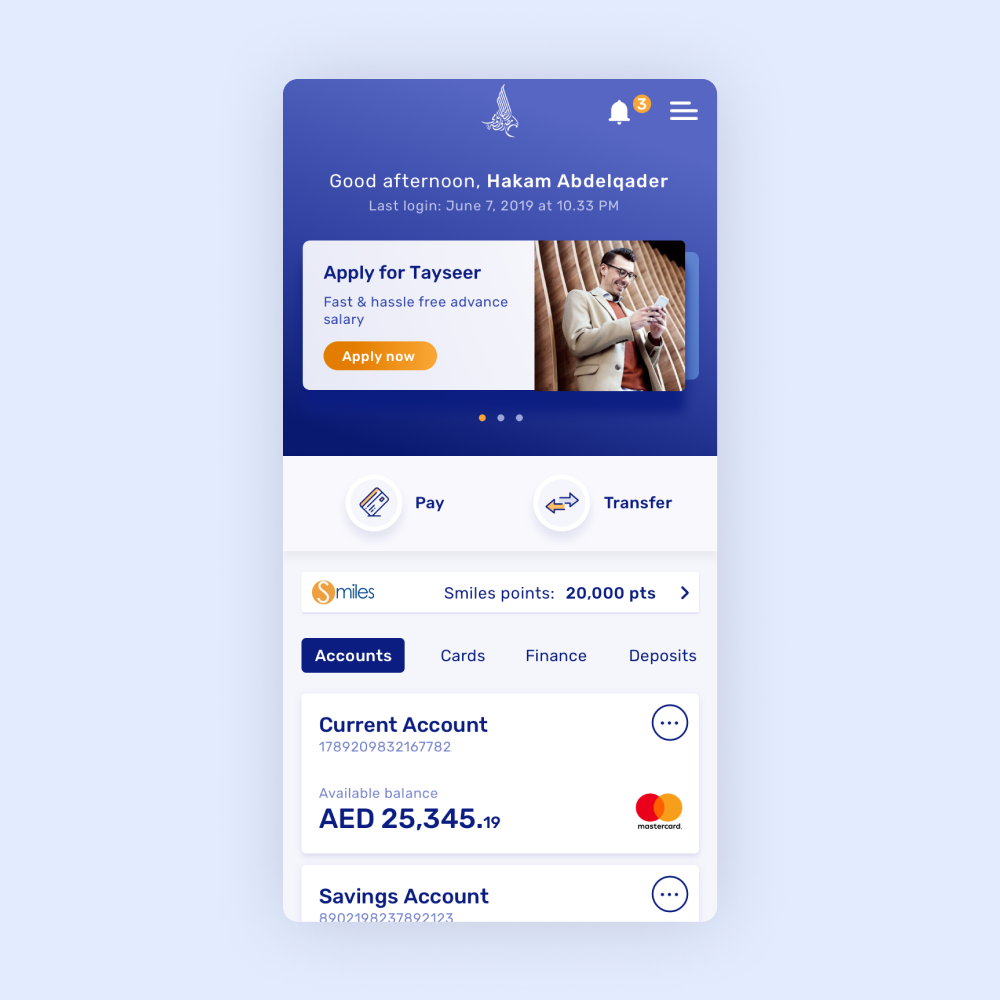

Digital and Mobile Banking Service

Digital and mobile banking service.

By Andy.